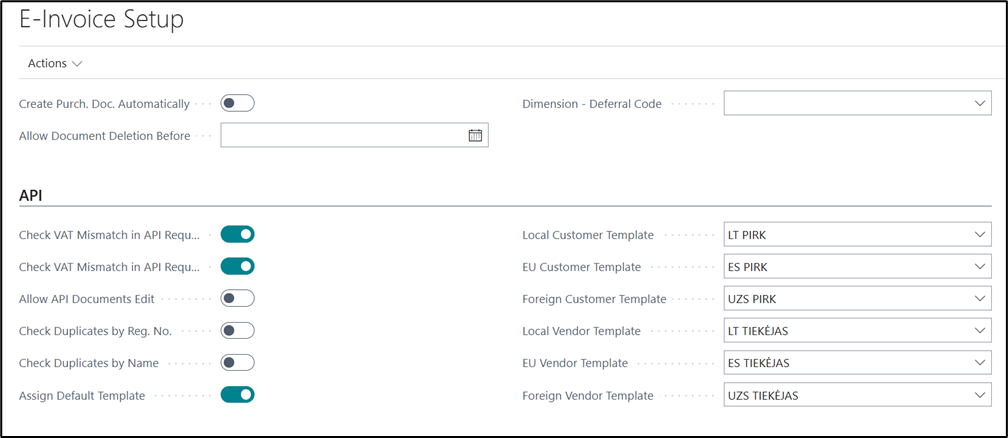

E-Invoice Setup

You can navigate to E-Invoice Setup page by entering the page name in search.

However, not all of these setups are relevant to API, only the fields described in the table below.

| Field | Description |

|---|---|

| Check VAT Mismatch in API Request (Purchase) | Ignores VAT mismatch check for purchase document creation, VAT can be adjusted using Correct VAT Differences in Purchase/Sales Documents (ESF) report. |

| Check VAT Mismatch in API Request (Sales) | Ignores VAT mismatch check for sales document creation, VAT can be adjusted using Correct VAT Differences in Purchase/Sales Documents (ESF) report. |

| Allow API Documents Edit | Documents created via E-Invoice API will have a property "Created via API" which by default prevents users from editing these documents. |

| Check Duplicates by Reg. No. | Enables checking of Registration Number in Customer/Vendor API. If system finds a record that has the same value, it throws an error and does not allow to insert a new record. |

| Check Duplicates by Name | Enables checking of customer/vendor Name in Customer/Vendor API. If system finds a record that has the same name, it throws an error and does not allow to insert a new record. |

| Assign Default Template | Indicates whether template code for customer/vendor should be assigned automatically. |

| Local Customer Template | Determines which template should be assigned to a local customer. A customer is considered local if they do not have a country assigned or if their country matches the one specified in the Company Information. |

| EU Customer Template | Determines which template should be assigned to EU customer. |

| Foreign Customer Template | Determines which template should be assigned to foreign customer. |

| Local Vendor Template | Determines which template should be assigned to a local vendor. A vendor is considered local if they do not have a country assigned or if their country matches the one specified in the Company Information. |

| EU Vendor Template | Determines which template should be assigned to EU vendor. |

| Foreign Vendor Template | Determines which template should be assigned to foreign vendor. |

Additional Setup for VAT mismatch check:

| Field | Description |

|---|---|

| Allow VAT Auto Correction | Allows for VAT Difference, that doesn't exceed Max. allowed VAT difference in General Ledger Setup, to be adjusted during POST action. |

How is VAT Mismatch calculated?

VAT Mismatch is calculated comparing apiTotalAmountInclVAT that is calculated in a third party system, with Total Amount Incl. VAT that is calculated in BC. We get an error if apiTotalAmountExclVAT and Amount calculated in BC does not match.